Interestingly, the unemployment rate is projected to hover around 4.1% during the same period, reflecting a healthy job market. For potential homebuyers, this suggests a favorable environment for securing employment and stable incomes, which are critical for obtaining mortgage approvals. On the other hand, sellers can expect a steady demand for housing driven by a robust job market.

Inflation rates are projected to ease, with core PCE inflation expected to decrease from 2.8% in 2024 to 2.0% by 2026. This trend is crucial for maintaining purchasing power and affordability in the housing market. Lower inflation rates can help keep mortgage rates in check, making homeownership more accessible for many families in St. Louis.

For a detailed breakdown of these projections and their implications for the St. Louis real estate market, please refer to the full report below.

Wolf Branch DIST 113 takes the top spot with an average of only 11 days on the market for its two active listings. The district also boasts an average list price of $399,750, making it an attractive option for families looking to settle down. Coming in at a close second is Winfield R-IV, with an average of 14 days on the market for its three listings. And last but not least, Windsor C-1 rounds out the top three with an average of 19 days on the market for its eight listings. For a complete list of the fastest selling school districts in the St. Louis metropolitan area, be sure to check out MORE, REALTORS®. With this valuable information in hand, you can make an informed decision when it comes to buying or selling a home in this vibrant and bustling region.

Navigating the competitive St. Louis real estate market, where inventory remains relatively low, requires strategic thinking and a well-crafted offer. While it’s possible to make an offer below the asking price, success hinges on several factors where the expertise of a seasoned professional agent, like those at MORE, REALTORS®, can be invaluable.

First, the amount of time a listing has been on the market is crucial. Properties that have lingered longer are often ripe for negotiation. A well-priced home will see significant activity, so an experienced agent can help you gauge the market response and determine a reasonable offer. Additionally, a property that has recently had its price reduced or has come back on the market after a failed contract may present prime opportunities for negotiation. Sellers in these situations may be more inclined to consider lower offers, especially when presented by a serious and well-prepared buyer.

Moreover, structuring your offer meticulously can make a significant difference. A strong offer isn’t just about the price; it includes having a solid, fully underwritten loan pre-approval, proof of funds, and carefully considered terms. Eliminating contingencies where possible, such as opting for an information-only inspection or perhaps no inspection at all (but not doing so blindly—a great agent can show you how to have the benefit of an inspection without the contingency), can also strengthen your position. Non-refundable deposits and other buyer commitments demonstrate seriousness and can sway sellers.

Where can you easily find listings where offers may be considered?

Trudging through thousands of listings looking for the “needle in the haystack” is time-consuming and frustrating for most buyers. However, there is a site, WillingToNegotiate.com, that simplifies finding these opportunities by showing only listings from the MLS that have had recent price reductions or have had a sale fail and are back on the market. These can be easily searched by the municipality or ZIP code they are in and then filtered even further. Utilizing these tools and working with skilled agents at MORE, REALTORS® can significantly increase your chances of securing a great deal in the St. Louis metro area.

Find Offer-Ready St Louis Listings Now!

The Department of Veterans Affairs (VA) has introduced a temporary variance allowing veterans to pay certain buyer-broker charges when using their VA-guaranteed home loan benefits. This change comes in response to the recent National Association of Realtors (NAR) settlement, which now prohibits the publication of buyer-agent compensation in Multiple Listing Services (MLS). The concern is that many sellers may no longer offer a commission to buyer agents, potentially making it challenging for veterans to secure representation. By allowing veterans to pay these charges directly, the VA aims to ensure they remain competitive in the current real estate market.

At MORE, REALTORS®, we are committed to staying ahead of industry changes to provide our clients with the best possible guidance. This new variance is a significant development for veterans, and we are here to help you navigate these changes effectively. Whether you are a veteran or a civilian, our team at MORE is ready to assist you with all your real estate needs. Contact us today to learn how we can support you in achieving your real estate goals.

Selling a home is a significant financial decision, especially for older adults who often have a substantial portion of their assets tied up in their home’s equity. While the idea of a quick sale to an investor might seem appealing, it rarely maximizes the financial potential of your property. Here’s why exposing your home to the market is the best strategy for securing the highest possible price, even if selling “as-is.”

The Drawbacks of Selling to an Investor

- Lower Offers

- Real estate investors typically seek properties they can buy at a discount, make necessary improvements, and then sell for a profit. As a result, their offers are often below market value. This approach might provide a quick sale, but it sacrifices significant potential profit. Caution – some investors plan on doing nothing to the home, find another buy to “flip it” to for a profit. The investors “profit” is money that you left on the table – money that could have been used for your care or your legacy.

- Missed Market Opportunities

- By bypassing the open market, sellers miss out on the competitive bidding process that can drive up the price. Multiple buyers interested in your home can lead to bidding wars, ultimately raising the final sale price.

Advantages of Exposing Your Home to the Market

- Competitive Pricing

- Listing your home on the open market allows you to receive offers from multiple buyers. This competition helps ensure you get the highest possible price, reflecting the true market value of your home.

- Broader Buyer Pool

- Exposing your home to the market means it reaches a wider audience, including owner-occupant buyers who may be willing to pay more than investors. These buyers are often looking for a place to live and may have emotional attachments that drive them to make higher offers.

- Selling “As-Is” to Owner-Occupants

- One common misconception is that only investors will buy homes “as-is.” In reality, many owner-occupant buyers are willing to purchase homes without requiring the seller to make repairs. These buyers might be looking for a fixer-upper they can customize to their liking, or they might be priced out of move-in-ready homes in their desired neighborhoods.

- Emotional Value

- Owner-occupants are often more emotionally invested in the purchase. They might fall in love with the neighborhood, the home’s unique character, or its potential, leading them to offer more than an investor who is focused purely on profit margins.

Considerations for Older Adults

- Equity Protection

- For many older adults, their home represents a significant portion of their net worth. Protecting and maximizing this equity is crucial for financial stability, especially during retirement. Selling on the open market typically ensures they receive the full value of their property, which is vital for funding future living arrangements, such as moving to an independent living or assisted living community or a senior apartment.

- Quick Sales Are Still Possible

- Listing on the market doesn’t necessarily mean a lengthy sales process. Homes can still sell quickly, especially in a competitive market. Setting a fair price, making minor aesthetic improvements, and marketing effectively can attract serious buyers promptly.

- Avoiding Elder Scams

- Elderly homeowners can be targets for scams and unfair offers. By working with a reputable experienced real estate agent and exposing the home to the market, seniors can avoid lowball offers and ensure they are getting fair market value. Try finding a Certified Senior Housing Professional™, Certified Downsizing Coach™, or Certified Senior Advisor

- Family Involvement

- Selling through traditional means allows for more transparency and involvement from family members, ensuring that decisions are made in the best interest of the senior’s financial and emotional well-being.

Practical Steps for Selling on the Market

- Hire a Knowledgeable Real Estate Agent

- An experienced agent can provide invaluable guidance through the process, from setting a competitive price to marketing the home effectively. They understand the nuances of the local market and can navigate the complexities of selling “as-is.” They often go by Certified Senior Housing Professional™, Certified Downsizing Coach™.

- Market the Home Effectively

- Professional photos, virtual tours, and open houses can attract a wide range of potential buyers. Highlighting the home’s strengths and potential can make it appealing even without extensive repairs.

- Set a Competitive Price

- Pricing the home accurately is critical. A price that reflects the home’s condition while remaining competitive will attract serious buyers quickly, leading to faster offers and potentially higher final sales prices.

- Consider Minor Upgrades

- While major repairs may not be feasible, minor improvements like fresh paint, landscaping, and thorough cleaning can significantly enhance the home’s appeal without substantial investment.

Conclusion

Selling a home, especially for older adults, should focus on maximizing the financial return to protect and capitalize on the home’s equity. Exposing the home to the open market rather than selling to an investor ensures a broader audience, competitive pricing, and potentially higher offers. There are times (few and far between) when selling to an investor makes sense. In those rare moments, hire an experienced real estate agent who can determine the true market value of the home in its current condition and then shop the home with multiple investors. This investor feeding frenzy often drives up what these cash buyers are willing to pay. I’ve been able to negotiate up to $90,000 more than the investor originally offered, “simply” by knowing the home’s true value and negotiating in the best interest of my client. Yes, I earned a commission, but the Seller is now even more comfortable in their retirement. By working with a knowledgeable real estate agent, you too can look forward an even more secure financial future.

The median list price for homes in the metro east update also saw a significant increase, rising 8.51% from $175000 in May 2023 to $189900 in May 2024. Additionally, there were 671 home sales in the metro east area during May 2024, a 6.00% increase from the 633 sales in May 2023.

These numbers demonstrate the continued strength and growth of the metro east real estate market. With increasing median sold and list prices, as well as a rise in home sales, it is clear that the demand for homes in this area remains high. Stay tuned for more updates on the metro east real estate market, exclusively from MORE, REALTORS®.

The median list price for homes in St Charles County also saw an increase of 5.82% from May 2023, reaching $364,989. Additionally, there were 433 home sales in May 2024, a significant 11.31% increase from 389 in May 2023.

These numbers indicate a strong seller’s market in St Charles County, with high demand and rising prices. As a leading real estate agency in the area, MORE, REALTORS® can provide expert guidance and assistance for those looking to buy or sell in St Charles County. Stay tuned for more updates and insights on the St Louis, MO real estate market.

Compared to the previous month, May 2024’s median sold price of $275,000 also saw a 5.81% increase from April 2024’s median sold price of $259,900. This steady growth in home prices is a positive sign for sellers in the stl msa.

Additionally, the median list price for homes in the stl msa was $269,900 in May 2024, an 8.18% increase from the median list price of $249,500 in May 2023. This indicates that sellers are able to list their homes for higher prices, and buyers are willing to pay.

The stl msa also saw an increase in home sales, with 3049 homes sold in May 2024, a 4.35% increase from May 2023’s 2922 home sales. This further demonstrates the strong demand for homes in the stl msa.

As the chart below, available exclusively from MORE, REALTORS®, shows, the stl msa real estate market continues to be a hot market for both buyers and sellers. With rising home prices and steady sales, now is a great time to buy or sell a home in the stl msa. Contact a MORE, REALTORS® agent today for expert guidance and assistance in navigating the stl msa real estate market.

The structural issues and subsequent lending restrictions have had a notable impact on property values and sales within Brentwood Forest. According to the STL Market Charts below, available exclusively from MORE, REALTORS®, the median price of condominiums sold in Brentwood Forest increased from $160,000 in 2019 to $220,000 in 2023. However, in light of the recent developments, Brentwood Forest condo prices have declined nearly 13% to $192,000 thus far in 2024. The 12-month sales trend, as the chart below illustrates, shows that during the past 5 years, condo sales peaked at 123 units sold in the 12-month period ending January 31, 2022, and have since steadily declined 50% to just 62 units sold during the 12-month period ending May 31, 2024. This decline is largely attributed to the hesitancy of lenders to approve mortgages for properties within the community, making it difficult for sellers to find buyers who are not cash purchasers or those utilizing portfolio loans.

The situation at Brentwood Forest reflects a broader trend affecting condominium communities across the nation. The increased scrutiny on long-term maintenance and structural integrity of condo buildings, spurred by incidents such as the 2021 Surfside, Florida collapse, has led to stricter lending criteria. Condominiums deemed “non-warrantable” by entities like Fannie Mae and Freddie Mac face similar challenges, with sales slowing and prices becoming volatile as a result. The case of Brentwood Forest underscores the importance of proactive maintenance and transparent governance in condo associations to maintain market confidence and ensure the financial stability of their communities.

This is why it’s important, when considering purchasing a condominium, that you be represented by a buyer’s agent with extensive knowledge and experience in condominium sales and challenges, as well as a good understanding of the current situations at area complexes so you are aware of issues like those at Brentwood Forest. You can find agents like this at MORE, REALTORS®.

Selling a home, especially for seniors, can be an emotional and complex process. Whether the decision stems from downsizing, moving to an assisted living community, or addressing economic security concerns, ensuring the home sells for its maximum value is crucial. Here’s how to achieve that, regardless of the home’s condition, without resorting to real estate investors who more often than not offer the best price.

Understanding the Motivation

Firstly, it’s essential to recognize why the sale is happening. Common reasons include:

- Downsizing for seniors to a more manageable living space.

- Transitioning to a senior apartment or assisted living community.

- Financial necessities, where economic security for seniors becomes a priority.

- Preparing for end of life scenarios and ensuring proper estate and financial planning.

Understanding the motivation helps tailor the selling strategy to meet specific needs and goals.

Essential Steps to Maximize Value

- Home Repair and Maintenance

- Minor Repairs: Focus on inexpensive but impactful fixes such as repairing leaky faucets, patching holes, and repainting walls. These improvements can significantly boost the home’s appeal.

- Major Repairs: If the home has more significant issues like a damaged roof or outdated electrical systems, consider whether these repairs are financially feasible. Sometimes, the increased sale price can justify the investment.

- Declutter and Depersonalize

- Remove personal items and excess clutter to make the home appear more spacious and allow potential buyers to envision themselves living there. This is especially important in the context of downsizing for seniors, where a lifetime of accumulated belongings can overwhelm the space.

- Professional Staging

- Staging a home can increase its perceived value. Professional stagers know how to highlight a home’s strengths and downplay its weaknesses, making it more attractive to buyers.

- Enhanced Curb Appeal

- First impressions matter. Simple landscaping, fresh paint on the front door, and clean walkways can make a big difference.

- Accurate Pricing

- Setting the right price is crucial. Overpricing can lead to the home sitting unsold, while underpricing leaves money on the table. An experienced real estate agent specializing in senior moves can provide a Comparative Market Analysis (CMA) to determine a competitive price.

Senior-Specific Considerations

- Elder Abuse and Scams

- Unfortunately, seniors are often targets for scams. Be cautious of offers that seem too good to be true or pressure to sell quickly. Consulting a trusted senior advocate or involving family members in the process can provide an extra layer of protection.

- Family Communication

- Transparent and open communication with family members is vital. Involve them in the decision-making process to ensure that everyone’s concerns and wishes are addressed. This is especially important if the sale is part of end of life planning or to ensure economic security for seniors.

- Aging in Place

- For seniors who prefer to age in place rather than move to a senior living community or senior apartment community, the focus might be on making the home more livable rather than selling. However, if selling is the chosen route, emphasize the home’s potential for other seniors looking to age in place. We’re talking grab bars, walk in showers, better lighting, non slip flooring, and a main floor laundry.

- Estate and Financial Planning

- Ensure that all financial and legal aspects are in order. This includes updating wills, trusts, and other estate planning documents. Consulting with a financial planner or estate attorney can ensure that the proceeds from the home sale are managed effectively to support future needs.

Marketing Strategies

- Professional Photography and Virtual Tours

- High-quality photos and virtual tours can attract more buyers, especially those who may be relocating from other areas. Highlight the home’s best features and any recent upgrades or repairs.

- Targeted Advertising

- Focus on marketing strategies that reach the right audience. For example, advertising in publications and websites frequented by seniors or their families can attract buyers who appreciate the value of a well-maintained home suitable for aging in place.

- Highlight Senior-Friendly Features

- If the home has features that are particularly beneficial for seniors, such as a single-story layout, grab bars, or a walk-in shower, make sure these are highlighted in all marketing materials.

- Open Houses

- Hosting open houses can create a sense of urgency and competition among buyers. Ensure the home is in top condition and consider offering light refreshments to make visitors feel welcome.

Choosing the Right Real Estate Agent

Working with a real estate agent experienced in senior transitions can make a significant difference. They understand the unique needs and concerns of senior sellers and can provide valuable guidance throughout the process. Ensure the agent is knowledgeable about elder abuse prevention, can spot potential scams, and is sensitive to the emotional aspects of selling a longtime home. When interviewing agents, ask them for examples of the resources they have in place to provide a turnkey solution. Some of the best prepared real estate professionals have designations like Certified Seniors Real Estate Specialist™ (CHSP), Certified Downsizing Coach (CDC)™ and Certified Senior Advisor®(CSA). CSA’s are background checked every 3 years.

Conclusion

Selling a home, regardless of its condition, requires careful planning and strategic execution, especially for seniors. By addressing necessary repairs, staging effectively, pricing correctly, and marketing to the right audience, seniors can maximize their home’s sale value. Ensuring family communication, protecting against scams, and integrating estate and financial planning are essential to achieving a successful and beneficial sale. Remember, the goal is not just to sell the home but to do so in a way that best supports the senior’s next life stage.

Why Not Work Directly with the Builder?

Builders often have sales agents on-site who are well-versed in their product, but these representatives work for the builder. Their primary goal is to protect the best interests of the builder, not to advocate for the best interests of the buyer. This means that they are focused on achieving the highest possible profit margins for the builder, which might not align with what is best for you as the buyer.

Without your own agent, you lack proper representation in negotiations and throughout the home-buying process. An experienced real estate agent can help you navigate the complexities of builder contracts, which often include terms that heavily favor the builder. Moreover, a buyer’s agent can negotiate upgrades, prices, and other terms more effectively, ensuring that you get the best possible deal and that your interests are protected from start to finish.

Engage an Agent Early

It’s vital to engage a real estate agent before you even visit the first builder display. Many builders have policies that may exclude paying a buyer’s agent if they were not present on your first visit, which could cost you money. By involving your agent from the outset, you ensure that you are fully represented in all interactions with the builder and their representatives. This can also prevent any potential misunderstandings and maximize the value you get from your investment. Additionally, having your agent involved early means they can help you evaluate different builders and communities, identify potential red flags, and provide valuable insights on the best options available, ensuring you make an informed decision from the very beginning.

Expertise in New Home Construction

Choosing an agent with in-depth knowledge and experience in new home construction can make a significant difference. Such agents are familiar with the construction quality, builder reputations, and the intricacies of new home warranties. They can provide valuable insights into the various options and upgrades available, helping you make informed decisions that add long-term value to your home. Additionally, they can offer an “apples-to-apples” comparison between builders and ensure you are aware of any future developments that might affect your new neighborhood. This expertise allows the agent to foresee potential issues and advocate for your best interests effectively, making the entire process smoother and more secure for you as a buyer.

Why Choose MORE, REALTORS?

At MORE, REALTORS, we have a team of agents with extensive experience and knowledge in selling new homes and building custom homes. Our experts are equipped to guide you through every step of the process, ensuring a smooth and beneficial home-buying experience. With a deep understanding of the local market and strong relationships with builders, we are committed to helping you make informed decisions and secure the best possible outcome for your new home purchase.

A Springfield, Missouri business owner, Brian Scroggs, has been indicted by a federal grand jury for orchestrating a fraudulent timeshare exit scheme, according to an announcement from the FBI. Scroggs, who owned Vacation Consulting Services, LLC, and The Transfer Group, LLC, promised clients he could help them exit their timeshare contracts for a fee. Despite knowing that timeshare companies had stopped working with exit firms, Scroggs continued to solicit new clients under false pretenses.

The indictment reveals that Scroggs defrauded clients of over $32,000 by falsely claiming his companies could release them from their timeshare agreements. His scheme involved hosting seminars across the country where he assured timeshare owners they could either get out of their contracts or receive a refund. However, none of these promises were fulfilled, leaving clients trapped in their timeshare agreements without the refunds they were promised.

This case, prosecuted by Assistant U.S. Attorney Patrick Carney and investigated by the IRS-Criminal Investigation and the FBI, serves as a stark reminder for timeshare owners to exercise caution and thoroughly vet any exit companies they consider using. Always seek advice from trusted real estate professionals, such as those at MORE Realtors INLINE TEXT Link – goes to agent website

MORE, REALTORS®, to avoid falling victim to similar scams.

From 2021 to 2023, the median total loan costs for home purchase loans surged by over 36%, with the median dollar amount paid by borrowers in 2022 nearing $6,000. These rising costs, coupled with increased home prices and interest rates, have significantly strained household budgets. The CFPB’s focus is on understanding the impact of these fees on home affordability and access to credit, particularly for first-time and lower-income buyers who are disproportionately affected.

The CFPB has launched a public inquiry into what they term “junk fees” in mortgage closing costs. According to CFPB Director Rohit Chopra, these excessive fees can drain down payments and push up monthly mortgage costs, making homeownership less accessible. The Bureau is seeking to uncover why these costs are rising, who benefits from them, and how they might be reduced to alleviate the financial burden on both borrowers and lenders.

Mortgage lenders are also affected by these rising costs. Increased expenses for services like credit reports and title insurance can limit lenders’ ability to offer competitive mortgages, as they either pass these costs onto borrowers or absorb them, affecting their bottom line. The CFPB is particularly interested in understanding the competitive pressures and market barriers affecting these fees, as well as gathering data on the broader impacts on housing affordability and home equity.

The CFPB is calling on homeowners, homebuyers, and industry participants to share their stories, data, and insights on mortgage closing costs. Comments can be submitted electronically via the Federal eRulemaking Portal or by email. Your feedback will help shape future regulations and policies aimed at ensuring fair and transparent mortgage practices. For more details, including submission instructions, refer to the full notice from the CFPB below.

House hacking offers numerous benefits, particularly in a market like St. Louis where property values are competitive and rental demand is strong. For first-time homebuyers, it provides an opportunity to enter the real estate market with lower financial risks. Investors can also leverage this strategy to diversify their portfolios and maximize returns. By renting out portions of their property, homeowners can enjoy the dual advantage of having a place to live while their tenants help pay down their mortgage.

If you’re considering house hacking or need expert advice on navigating the St. Louis real estate market, the experienced agents at MORE, REALTORS® are here to help. With a deep understanding of the local market trends and a commitment to client success, they can guide you through every step of the home buying process.

As we commemorate Memorial Day, it’s a time for reflection on our history and community. In St. Louis, Memorial Day holds particular significance, intertwining with our city’s rich historical tapestry.

The Historical Roots of Memorial Day in St. Louis

Memorial Day, originally known as Decoration Day, was established after the Civil War to honor fallen soldiers. St. Louis, with its strategic location and historical military significance, has always played a pivotal role in these commemorations. Jefferson Barracks National Cemetery, one of the oldest military cemeteries in the United States, serves as the final resting place for over 188,000 soldiers, spanning conflicts from the Revolutionary War to the present day. Each year, the cemetery becomes a focal point for Memorial Day activities, reminding us of the sacrifices made by countless individuals to protect our freedoms.

Community and Neighborhood Celebrations

Memorial Day serves as a reminder of the importance of community and remembrance. Neighborhoods throughout St. Louis host events and parades, fostering a sense of unity and pride. Here are some notable celebrations:

Jefferson Barracks National Cemetery: Annual Memorial Day Ceremony

- Event: Memorial Day Wreath-Laying Ceremony

- Time: 10:00 AM

- Details: Military honors, commemorative speeches, playing of Taps, and a rifle volley.

- Location: Jefferson Barracks National Cemetery, 2900 Sheridan Road, St. Louis, MO

Soldiers Memorial Military Museum: Memorial Day Ceremony

- Event: Memorial Day Ceremony

- Time: 10:00 AM – 12:00 PM

- Details: Adding names of 254 St. Louisans who died in the Vietnam War to the Court of Honor, performances by the Red and Black Brass band, and a procession to the Court of Honor.

- Location: 1315 Chestnut St., downtown St. Louis, MO

Lafayette Square: Memorial Day Picnic

- Event: Memorial Day Picnic

- Time: 11:00 AM – 2:00 PM

- Details: The neighborhood association organizes a picnic in Lafayette Park, featuring historic home tours, live music, and activities for children, celebrating the community’s heritage and honoring those who served.

- Location: Lafayette Park, Lafayette Square, St. Louis, MO

Belleville Memorial Day Parade

- Event: Annual Memorial Day Parade

- Time: Parade starts at 10:00 AM, Memorial Day Program starts at 11:00 AM

- Details: Parade route ends at Walnut Hill Cemetery, followed by a Memorial Day Program.

- Location: Downtown Belleville, IL

Central West End: Memorial Day Parade and Walking Tour

- Event: Memorial Day Parade and Walking Tour

- Time: Parade at 10:00 AM, Walking Tour at 12:00 PM

- Details: The parade winds through the Central West End neighborhood, followed by a local history walking tour highlighting the area’s historical significance and military connections.

- Location: Central West End, St. Louis, MO

Forest Park: Memorial Day 5K Run

- Event: Memorial Day 5K Run

- Time: 8:00 AM

- Details: A 5K run through Forest Park, followed by a memorial service at the park’s Soldiers Memorial, honoring fallen soldiers with speeches and a moment of silence.

- Location: Forest Park, St. Louis, MO

The Delmar Loop: Memorial Day Street Festival

- Event: Memorial Day Street Festival

- Time: 11:00 AM – 5:00 PM

- Details: A street festival featuring live music, food vendors, and special performances, including a tribute to local veterans and active-duty military personnel.

- Location: Delmar Loop, St. Louis, MO

University City Memorial Day Run

- Event: 50th Annual University City Memorial Day Run

- Time: 7:30 AM – 12:00 PM

- Details: This event features a 10K run starting at 7:30 AM, a 5K run starting at 7:50 AM, and a Family Fun Run starting at 9:15 AM. The runs begin in front of the University City Public Library and pass by many of University City’s landmarks and beautiful gardens. Proceeds from the event benefit the University City Public Library, The Green Center, and U City in Bloom.

- Location: University City Public Library, 6701 Delmar Blvd, University City, MO

Ballwin Memorial Day Ceremony

- Event: Memorial Day Ceremony

- Time: 11:15 AM

- Details: Includes Color Guard VFW Post 6274 and a performance by the Donneresas.

- Location: Peace Memorial at Vlasis Park, Ballwin, MO

Manchester Memorial Day Remembrance Ceremony

- Event: Memorial Day Remembrance Ceremony

- Time: 10:00 AM

- Details: The ceremony will feature U.S. Navy Reserve Commander Sam Fletcher as the speaker, and will include a bald eagle from the World Bird Sanctuary, music by the Manchester Community Band, and the Flags of Valor presentation, recognizing service members killed in action since September 11.

- Location: Veterans Memorial in Stoecker Park, 222 Henry Ave, Manchester, MO

Sappington-Concord Historical Society Memorial Day Ceremony

- Event: Memorial Day Ceremony

- Time: 10:00 AM

- Details: The traditional ceremony will include community participation and honor local veterans. The Sappington-Concord Historical Society hosts this event, which is a long-standing tradition in the area.

- Location: Sappington-Concord Historical Society, Sappington, MO

Alton Memorial Day Parade

- Event: Alton Memorial Day Parade

- Time: 10:00 AM

- Details: The Alton Memorial Day Parade is touted as the oldest consecutive Memorial Day parade in America, having run every year since 1868. The celebration begins at Alton Middle School and concludes at the Alton City Cemetery. The parade features various floats, marching bands, and community groups, all coming together to honor those who have served and sacrificed.

- Location: Starts at Alton Middle School, 2200 College Ave, and ends at Alton City Cemetery, 1205 East 5th St., Alton, IL

Collinsville Memorial Day Service

- Event: Collinsville Memorial Day Service

- Time: 10:30 AM

- Details: The Collinsville Memorial Day Service will be held at the Collinsville VFW. The event will feature a guest speaker, John Shimkus, and a performance by the Collinsville High School band. A light lunch will be served following the ceremony, allowing the community to gather and reflect on the significance of the day.

- Location: Veterans of Foreign Wars, 1234 Vandalia Street, Collinsville, IL

Wings Over St. Louis

- Event: Wings Over St. Louis

- Time: 9:00 AM – 5:00 PM

- Details: This event at the Spirit of St. Louis Airport in Chesterfield features historic warbird flights, static displays of vintage aircraft, and educational activities. Visitors can ride in one of the warbirds, view historic military vehicles, and participate in interactive learning experiences. The event is family-friendly and offers a unique opportunity to experience aviation history up close.

- Location: Spirit of St. Louis Airport, 18270 Edison Ave, Chesterfield, MO

These community events not only honor the memory of those who served but also enhance the appeal of St. Louis neighborhoods, making them attractive to potential homebuyers looking for areas with a strong sense of community and history.

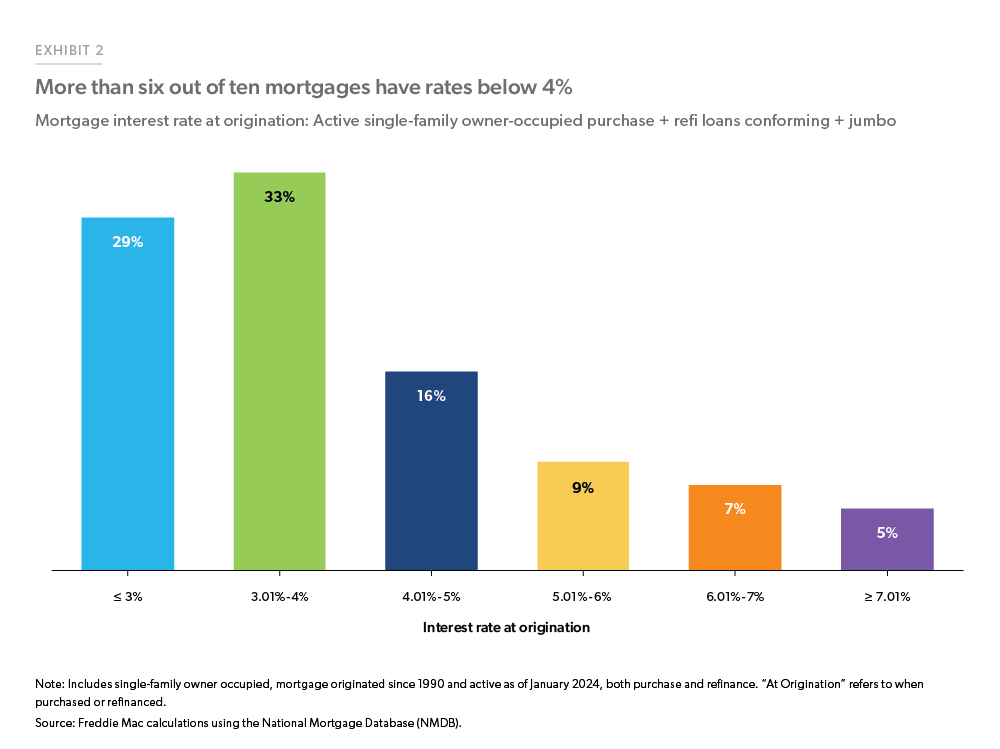

Analyzing the borrower-level National Mortgage Database, it becomes clear that Millennials and Gen Xers have benefited most from the low-rate environment, with average rates around 4%. Millennials, who entered the market en masse during the low-rate period of 2020-2021, secured favorable rates primarily through purchases, while Gen Xers capitalized on refinancing opportunities. In contrast, Gen Z, stepping into the market more recently, faces the highest average rates at 4.9%, with many having purchased homes during the higher rate periods of 2022 and 2023. This generational disparity in mortgage rates suggests that while refinance opportunities remain slim, should rates decline, there could be significant refinancing activity, especially among Gen Xers and Millennials.

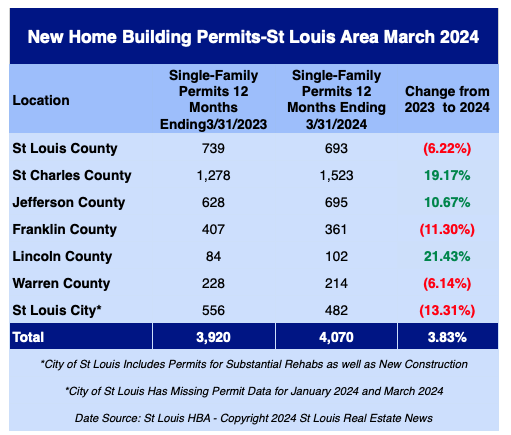

Percentage of Homeowners with Mortgages at Various Rate Levels

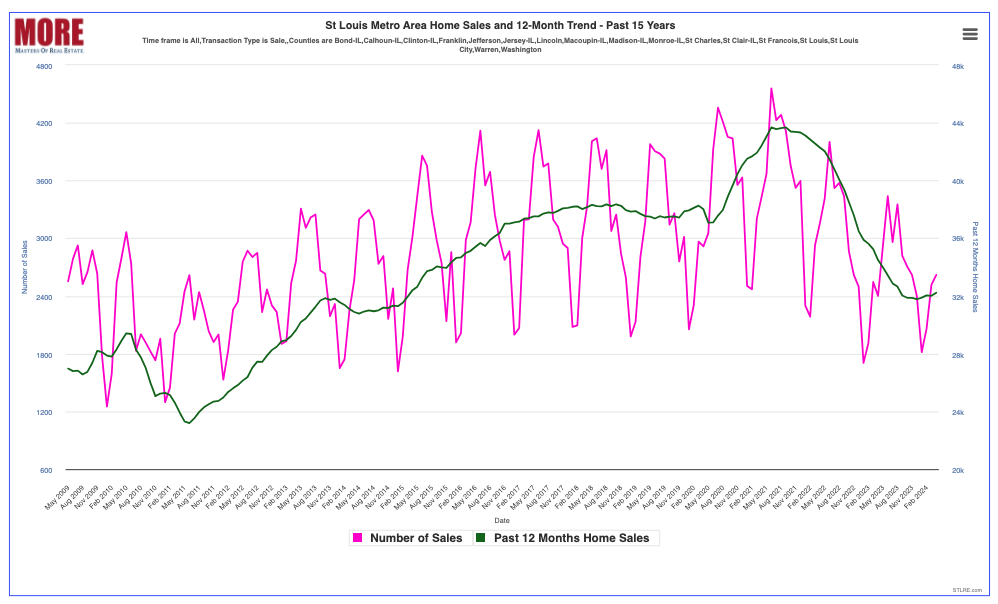

While this year’s YTD home sales may be lower compared to four years ago, with a decrease of 11.78%, it is important to note that the overall trend is still positive. This is great news for both potential home buyers and sellers in the St. Louis metro area, as it indicates a stable and growing real estate market. For those looking to buy or sell a home, it is worth considering the fastest selling zip codes in the area, which can be found in the complete list provided by MORE, REALTORS®. So if you’re thinking about making a move in the St. Louis metro area, now is a great time to do so.

But that’s not all. The second and third fastest selling districts in the St. Louis metro area are also located in Madison-IL, IL and St Clair-IL, IL, respectively. These areas have an average of 6 and 12 days on the market, making them hot spots for both buyers and sellers. So, whether you’re a family looking for a new home or an investor searching for a lucrative opportunity, these zip codes are worth considering.

To see the complete list of the fastest selling zip codes in the St. Louis metro area, be sure to check out MORE, REALTORS®. With their expertise and knowledge of the local market, they can help you find the perfect home or sell your property quickly and efficiently. Don’t miss out on these hot zip codes – start your search with MORE, REALTORS® today!

For those looking to buy or sell a home in these areas, this is great news. The fast pace of these school districts means that homes are in high demand and are selling at a quick rate. And for families, this is a great opportunity to find a home in a top-performing school district. For a complete list of the fastest selling school districts in the St. Louis metropolitan area, be sure to check out MORE, REALTORS®. Don’t miss out on your chance to be a part of these thriving communities. Start your home search or listing process today!

However, there was a slight decrease of 0.40% compared to March 2024, when the median sold price was $184,450. The median list price also saw a significant increase, rising by 8.79% from $170,000 in April 2023 to $184,950 in April 2024.

The number of home sales in the metro east update also saw a significant increase, with 626 homes sold in April 2024 compared to 510 in April 2023. This represents a 22.75% increase, indicating a strong demand for homes in the area.

As the chart below, available exclusively from MORE, REALTORS®, illustrates, the metro east real estate market continues to be a hot market for both buyers and sellers. With rising home prices and a high number of sales, it’s a great time to be a part of the metro east real estate market.

If you’re considering buying or selling a home in the metro east area, don’t hesitate to contact MORE, REALTORS® for expert guidance and assistance. Our team of experienced real estate agents will help you navigate the market and make the most informed decisions. Stay tuned for more updates on the metro east real estate market.

While there was a slight decrease of 2.82% from the previous month, when the median sold price was $370,450, the overall trend for home prices in St Charles County remains positive. Additionally, the median list price for homes in April 2024 was $350,000, which is the same as it was in April 2023.

The number of home sales in St Charles County also saw an increase, with 365 homes sold in April 2024. This is a 4.89% increase from April 2023, when there were 348 home sales.

As the market continues to show stability and growth, now is a great time to buy or sell a home in St Charles County. Contact MORE, REALTORS® for expert guidance and assistance with all of your real estate needs.

The median list price for homes in Franklin County was $246,450, a 6.02% increase from April 2023. In terms of sales, there were 108 homes sold in April 2024, a significant 54.29% increase from April 2023.

For a visual representation of this data, refer to the chart below, available exclusively from MORE, REALTORS®. This data indicates a strong and active real estate market in Franklin County, making it a desirable location for both buyers and sellers. Stay tuned for more updates on the Franklin County real estate market.

The median list price for homes in St. Louis was $250,000, a slight 0.04% increase from April 2023. This indicates that sellers are still able to command a strong price for their homes in the current market.

In terms of sales, there were 2,634 home sales in the St. Louis metro area in April 2024, a 9.70% increase from April 2023. This shows a continued high demand for homes in the area.

For those looking to buy or sell a home in the St. Louis metro area, now is a great time to take advantage of the strong market conditions. With the help of a knowledgeable and experienced REALTOR from MORE, REALTORS®, buyers and sellers can navigate this competitive market with confidence. Stay tuned for more updates on the St. Louis real estate market.

Lawrence Yun, Chief Economist for the National Association of REALTORS

In his forecast yesterday at the 2024 REALTORS® Legislative Meetings, National Association of Realtors® Chief Economist Lawrence Yun delivered a promising outlook for the real estate market with expectations for rising existing-home sales. According to Yun, the U.S. is likely to see existing-home sales increase to 4.46 million in 2024, a 9% rise from 2023, and surge to 5.05 million in 2025. Yun highlighted, “More jobs mean more home sales and higher housing demand. You need a strong local economy for a strong housing market.”

Additionally, Yun noted a significant calming in rental markets, which will help stabilize the consumer price index, encouraging the Federal Reserve to consider lowering interest rates. He remarked, “The Federal Reserve has delayed rate cuts. I would have thought that, by now, rates would be lower and rate cuts would have begun. Whatever rate cut the Federal Reserve does not do this year will simply get pushed back to 2025.”

For individuals looking to navigate the St. Louis real estate market, the expertise of MORE, REALTORS® can prove invaluable. Our agents are equipped with the latest insights and are prepared to guide clients through the intricacies of buying or selling homes in today’s economic landscape. As Yun emphasized, the strong economic fundamentals support a vibrant housing market, underscoring real estate as a prudent investment for building personal wealth.

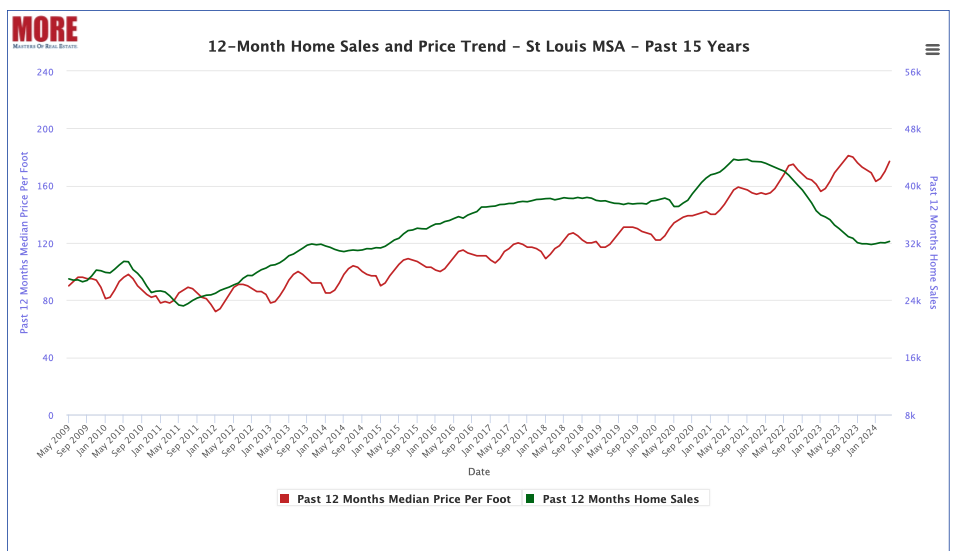

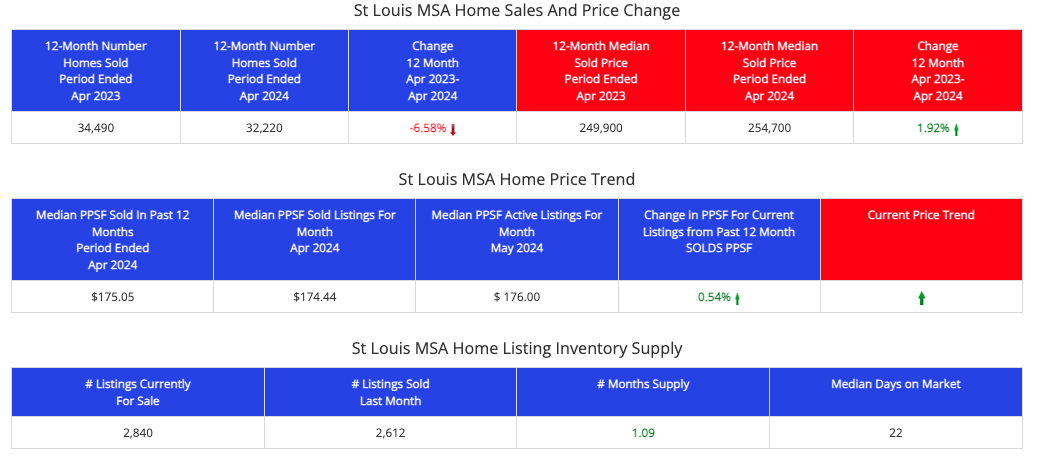

Conversely, the median sold price for homes has edged upwards, indicating a resilient market valuation. The median sold price for homes in St Louis rose by 1.92% from $249,900 in the prior year to $254,700 in the period ending April 2024. This growth suggests a sustained buyer interest in value, despite the lower sales volume.

Inventory dynamics also present an intriguing picture. The number of listings sold last month was 2,612, with current listings standing at 2,840, and a supply of just over one month (1.09 months). These figures, coupled with a median of 22 days on market, highlight a competitive and swift market environment, challenging both buyers and sellers to act efficiently.

The STL Market Report below, available exclusively from MORE, REALTORS®, has more details on the above information as well as additional useful St Louis market data as well. For prospective buyers, sellers, and investors, understanding these market dynamics is crucial. The expertise of MORE, REALTORS® can provide the necessary guidance and strategic advice to effectively navigate this evolving market landscape.

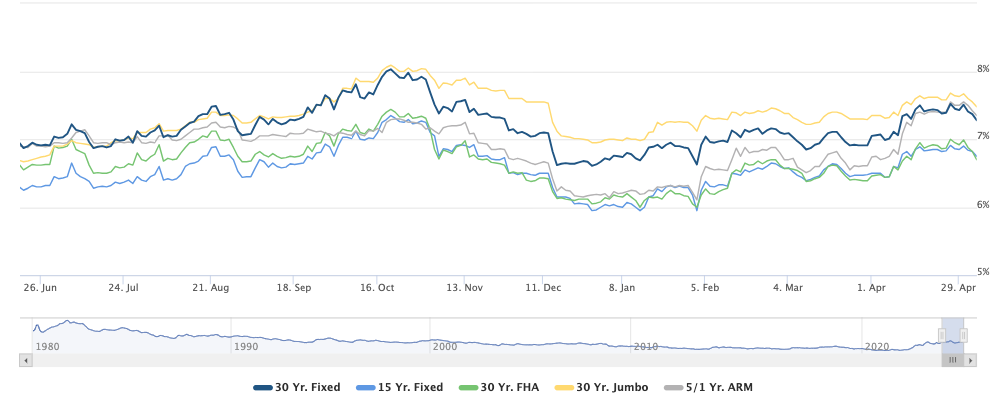

Although the accompanying chart traces the trajectory of interest rates over the past 40 years, extending back to 1980, it does not predict their future movements. The direction of mortgage rates is influenced by a myriad of factors including, but not limited to, Federal Reserve policies, inflation expectations, and global economic conditions. Currently, experts are closely monitoring the Fed’s monetary policy adjustments in response to inflation rates. Historical data suggests that significant shifts in policy can lead to rapid changes in mortgage rates. Therefore, potential homebuyers and investors should stay informed through reliable financial news sources and consult with seasoned real estate professionals, such as those at my company, MORE, REALTORS®, to navigate the complexities of the mortgage market effectively.